Shared Home Ownership is a more affordable way to purchase a home for you and your whānau.

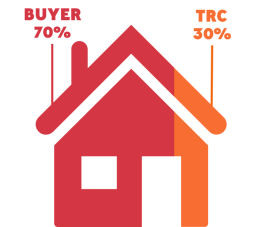

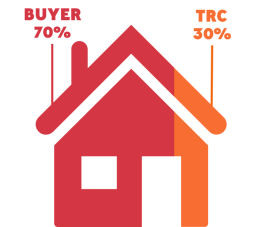

Through Tāmaki Regeneration’s Shared Home Ownership Programme OWN IT, we cover up to 30% of your home’s total value which means you pay less upfront with a lower deposit and lower mortgage repayment rates.

For example, for an $800,000 home:

On the open market: You may require a 20% deposit, which is $160,000. Your mortgage would be $640,000, making your weekly repayments $885 on 30 yr term interest rate of 6%.

Through the OWN IT programme, you buy 70% of the home and we require a 5% deposit, which is $40,000. Your mortgage would be $520,000, making your weekly repayments $720 on 30 yr term interest rate of 6%. TRC own remaining 30% of your home and over time you buy back our 30% share off us, until the home is 100% yours! We give you up to 20 years to complete this process.

Our friendly team will guide you through the process to provide all the knowledge and support on your journey towards full home ownership.